Why Crypto Portfolio Diversification Matters

Crypto portfolio diversification significantly improves risk-adjusted returns across multiple trading strategies. Our data shows diversified portfolios outperform single-asset holdings with higher Sharpe ratios, reduced drawdowns, and in some cases, superior absolute returns.

We have written multiple articles on trading strategies, such as Macd Indicator, Short-term RSI Reversal, and Trend Following. A common theme across these strategies has been the universal improvement of risk-adjusted results when we include additional assets through crypto portfolio diversification. This is not a coincidence, and implementing proper crypto asset allocation across multiple cryptocurrencies can substantially enhance your trading results.

What is Crypto Portfolio Diversification?

Crypto portfolio diversification involves spreading investments across multiple cryptocurrencies to reduce overall portfolio risk while potentially improving returns. Unlike traditional markets, the cryptocurrency market offers unique diversification benefits due to varying correlations between assets, different technological foundations, and distinct use cases.

Effective crypto asset allocation can:

- Reduce overall portfolio volatility

- Minimize exposure to single-asset risk

- Improve risk-adjusted returns (measured by Sharpe and Calmar ratios)

- Provide exposure to different blockchain ecosystems and use cases

Let's examine the data that demonstrates these cryptocurrency diversification benefits.

Buy And Hold Strategy: Single Assets vs. Diversified Portfolio

Bitcoin Buy and Hold

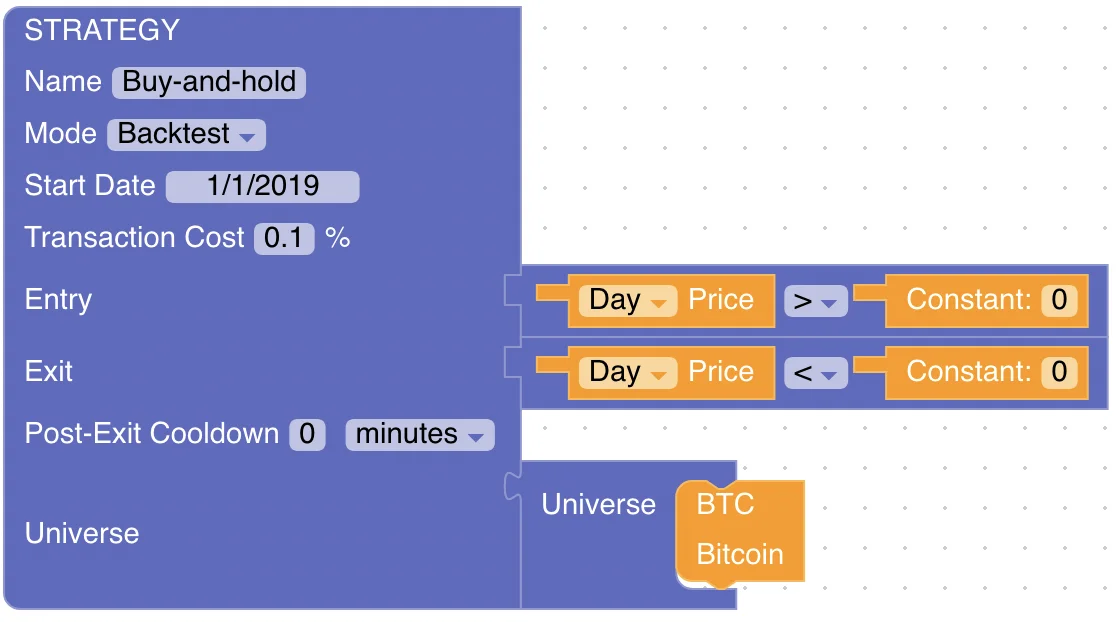

Let's start with simple buy-and-hold portfolio. We can simply define it as follows:

Results of this strategy can be inspected in detail here.

| Statistic | Value |

|---|---|

| Annualized Return | 65.25% |

| Volatility | 64.76% |

| Max Drawdown | 76.64% |

| Sharpe Ratio | 1.01 |

| Calmar Ratio | 0.85 |

Ethereum Buy and Hold

Let's repeat the same process for Ethereum. Results can be inspected here.

| Statistic | Value |

|---|---|

| Annualized Return | 48.67% |

| Volatility | 83.41% |

| Max Drawdown | 79.23% |

| Sharpe Ratio | 0.58 |

| Calmar Ratio | 0.61 |

Ethereum shows worse performance than Bitcoin in isolation, but as we'll see, including it in a portfolio still improves overall results.

Cardano Buy and Hold

We'll complete our single-asset analysis with Cardano, with results available here.

| Statistic | Value |

|---|---|

| Annualized Return | 54.25% |

| Volatility | 103.00% |

| Max Drawdown | 91.85% |

| Sharpe Ratio | 0.53 |

| Calmar Ratio | 0.59 |

Benefits of a Diversified Crypto Portfolio

Now let's examine a buy-and-hold portfolio that allocates equal weight to each cryptocurrency. Results are available here.

| Statistic | Value |

|---|---|

| Annualized Return | 102.91% |

| Volatility | 75.30% |

| Max Drawdown | 76.08% |

| Sharpe Ratio | 1.37 |

| Calmar Ratio | 1.35 |

This data clearly demonstrates the cryptocurrency diversification benefits. The diversified portfolio achieves:

- 58% higher returns than the best single-asset (Bitcoin)

- Better Sharpe ratio than any individual cryptocurrency

- Improved Calmar ratio showing better returns relative to maximum drawdown

- Manageable volatility despite including high-volatility assets

Trend-Following Strategy and Crypto Portfolio Diversification

Let's see if diversification also improves results for active trading strategies.

Bitcoin Trend-Following

Let's revisit the trend-following strategy from our previous article.

The Bitcoin-only trend-following strategy produced the following results:

| Statistic | Value |

|---|---|

| Annualized Return | 54.49% |

| Volatility | 31.44% |

| Max Drawdown | 28.36% |

| Sharpe Ratio | 1.73 |

| Calmar Ratio | 1.92 |

Diversified Trend-Following Performance

In our previous article, we didn't investigate how diversification could improve these results. Let's examine that now. Results can be inspected here.

| Statistic | Value |

|---|---|

| Annualized Return | 53.11% |

| Volatility | 29.79% |

| Max Drawdown | 24.08% |

| Sharpe Ratio | 1.78 |

| Calmar Ratio | 2.21 |

While the annualized return is slightly lower, the risk metrics improved substantially, resulting in better Sharpe and Calmar ratios. This demonstrates that diversification works not only for buy-and-hold strategies but is also effective for trend-following approaches.

Short-Term RSI Reversal and Crypto Asset Allocation

Finally, let's examine our RSI reversal strategy with and without diversification.

BTC RSI Strategy

In our RSI article, we tested an RSI strategy on BTC, which can be viewed here.

| Statistic | Value |

|---|---|

| Annualized Return | 19.67% |

| Volatility | 27.45% |

| Max Drawdown | 23.34% |

| Sharpe Ratio | 0.72 |

| Calmar Ratio | 0.84 |

Diversified RSI Strategy Results

We also examined a diversified portfolio using the same RSI strategy, which can be viewed here.

| Statistic | Value |

|---|---|

| Annualized Return | 24.01% |

| Volatility | 28.00% |

| Max Drawdown | 21.84% |

| Sharpe Ratio | 0.86 |

| Calmar Ratio | 1.10 |

Once again, diversification improved both the absolute returns and risk-adjusted metrics of the strategy.

Conclusion: Why Crypto Portfolio Diversification Matters

Our analysis demonstrates that diversification has improved results across all three tested approaches: buy-and-hold, RSI strategy, and trend-following strategy. The benefits include:

- Higher overall returns in some cases

- Reduced drawdowns

- Improved risk-adjusted metrics (Sharpe and Calmar ratios)

Diversification is a simple yet effective way to improve portfolio results, regardless of your trading strategy. By spreading risk across multiple cryptocurrencies, investors can capture gains while reducing the impact of severe downturns in any single asset.

FAQ About Crypto Portfolio Diversification

How many cryptocurrencies should I include in a diversified portfolio?

While our example used three cryptocurrencies, we recommend that 5-10 carefully selected assets can provide optimal diversification benefits without overcomplicating management.

Does crypto portfolio diversification work in bear markets?

Yes, diversification typically helps reduce drawdowns during market-wide corrections, though all crypto assets may experience high correlation during extreme market stress.

What's the best way to allocate assets in a crypto portfolio?

Equal weighting is a simple starting point, but market cap weighting or volatility-adjusted allocation can also be effective approaches to crypto asset allocation.

How often should I rebalance my diversified crypto portfolio?

Monthly or quarterly rebalancing is common, but the optimal frequency depends on market conditions and transaction costs.