MACD for Crypto: How to Use It for Smarter Trading

This strategy is based on a trend-following indicator designed to capture sustained price moves. However, like most trend-following tools, it may generate false signals during sideways or low-volatility markets.

What is MACD?

The MACD (Moving Average Convergence Divergence) is a momentum-based trend-following indicator. It consists of:

- MACD line: difference between the 12-period and 26-period exponential moving averages (EMAs)

- Signal line: 9-period EMA of the MACD line

- Histogram: difference between the MACD and Signal line

Traders use MACD to identify bullish crossovers (MACD crossing above Signal) and bearish crossovers (MACD crossing below Signal). It's particularly helpful in crypto markets to detect momentum shifts.

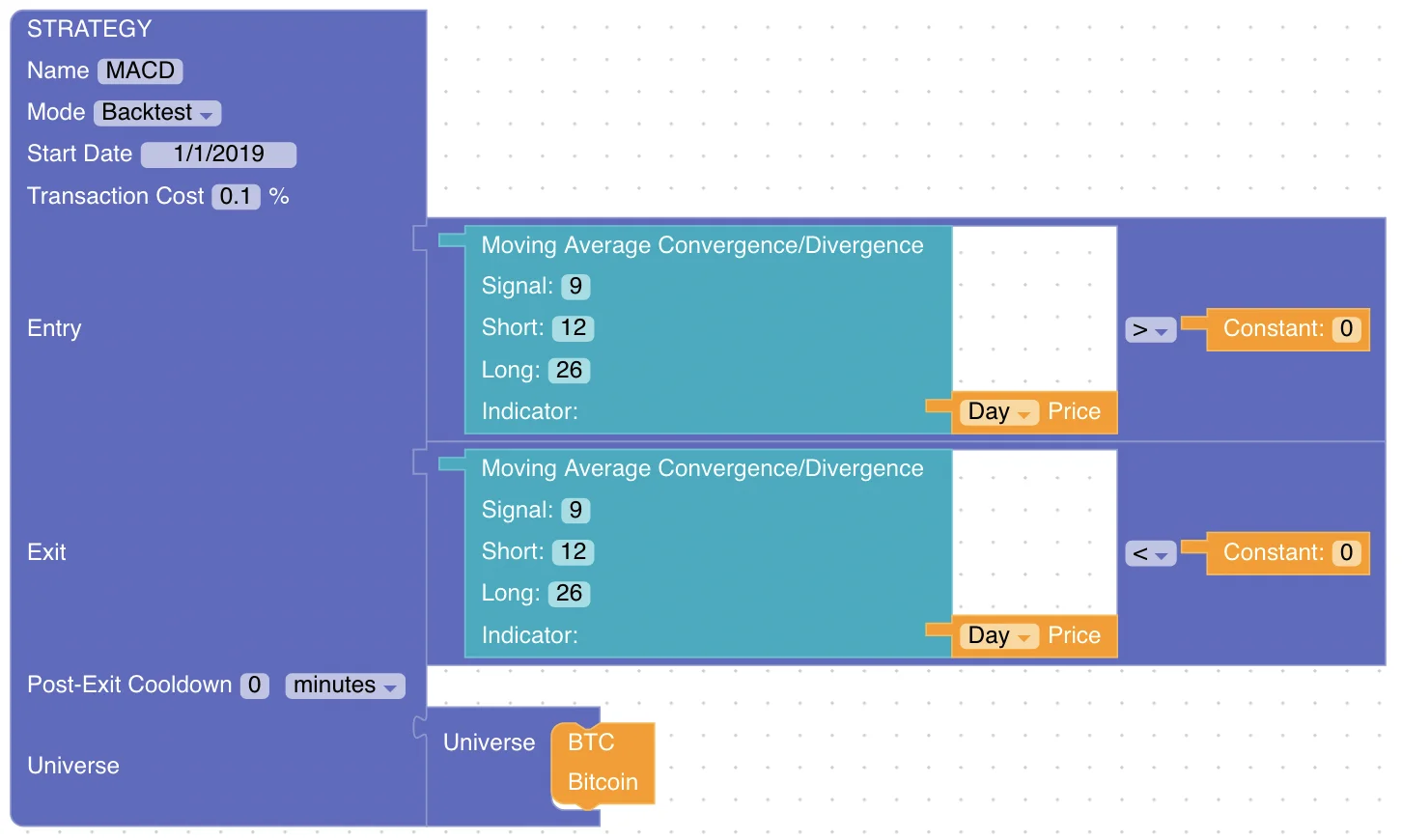

Our MACD Strategy Rules

Let's define the strategy as follows:

- Buy: When MACD line crosses above Signal line → enter long

- Sell: When MACD line crosses below Signal line → exit (move to cash)

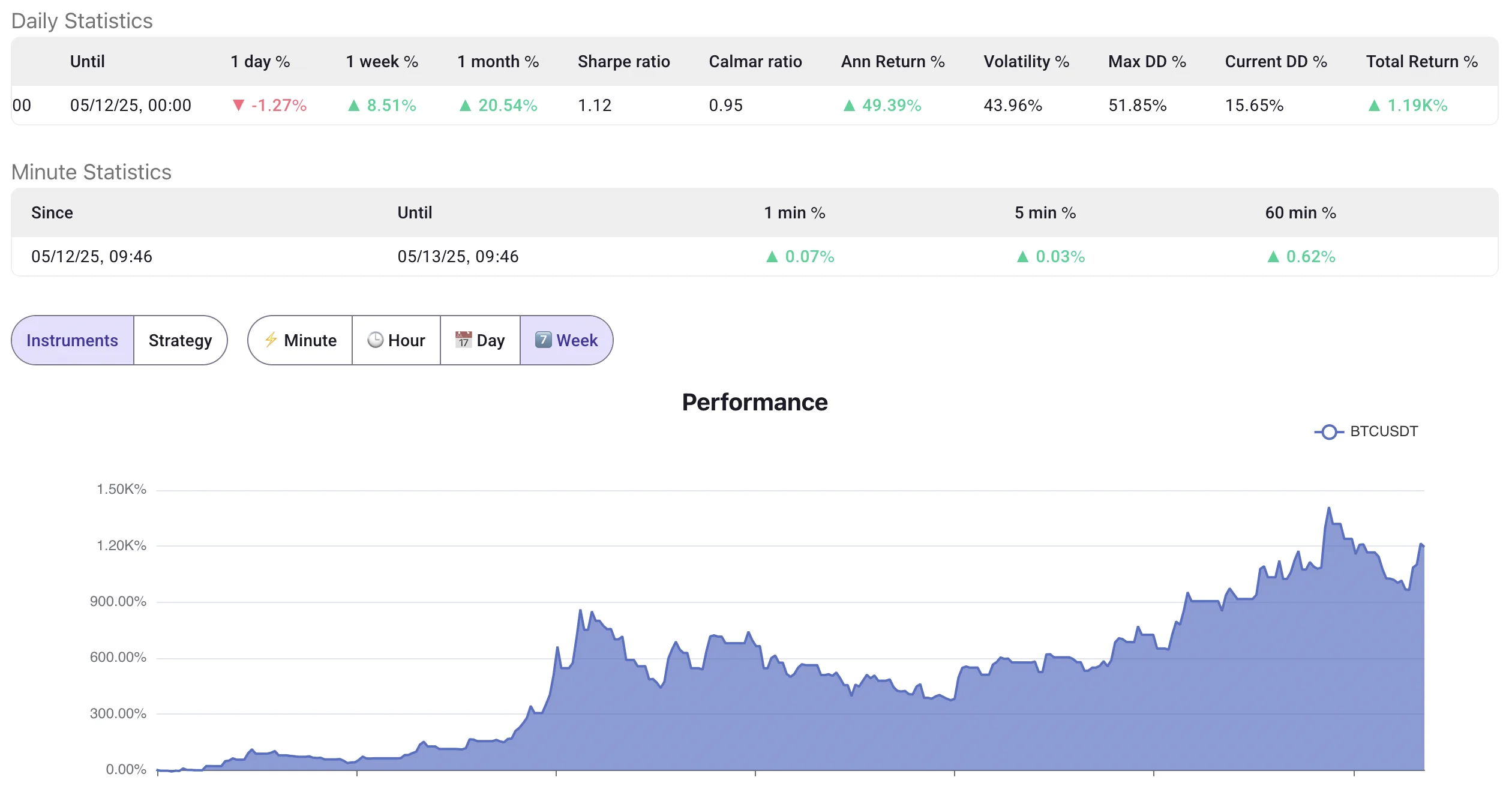

Strategy Performance

Here are the results of the strategy on Bitcoin (BTC):

- Annualized Return:

49.39% - Maximum Drawdown:

51.85%

Strategy results can be inspected here.

The strategy captures major uptrends while avoiding drawdowns during weak markets, resulting in attractive performance with lower exposure.

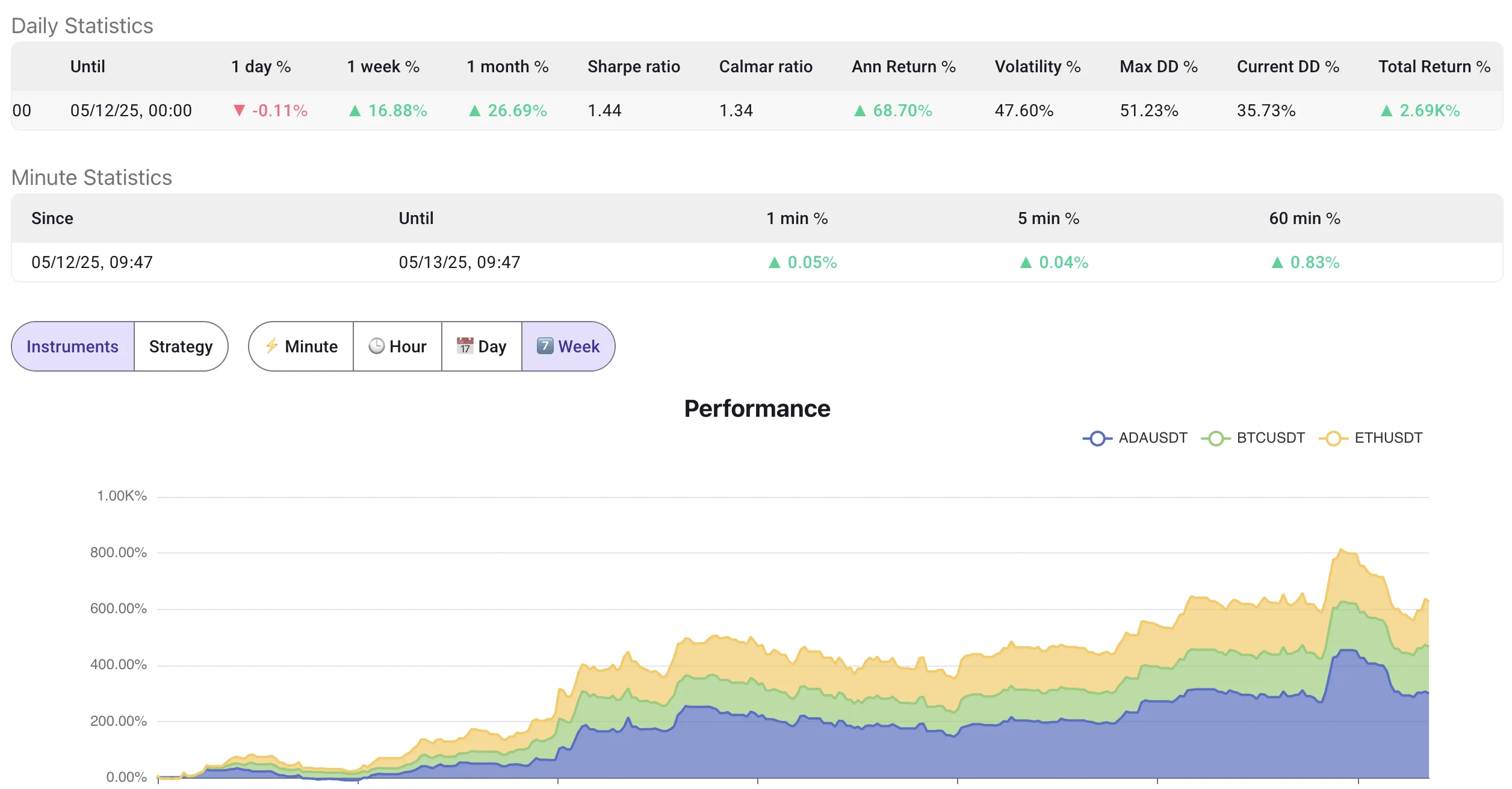

Diversification Improvement

To make the strategy more robust, we applied the same MACD rules to Ethereum (ETH) and Cardano (ADA):

Key improvements:

-

More consistent performance across market conditions

-

Reduced volatility in returns

-

Increased trade opportunities through asset rotation

-

Annualized Return:

68.70% -

Maximum Drawdown:

51.23% -

Sharpe Ratio:

1.44 -

Calmar Ratio:

1.34

Backtest results: see here

Live Implementation

This strategy is running live with real-time tracking:

👉 Live Strategy

It manages three crypto assets and updates as new MACD signals are generated.

Potential Strategy Improvements

- Signal Filtering: Combine with other trend following indicator to better filter uptrend periods and reduce time in market.

- Parameter Tuning: Run multiple backtests to find more optimal MACD parameters, we just used default ones here.

- Asset Expansion: Add more liquid crypto assets to increase diversification and risk-adjusted return. Using three assets instead of one clearly improved the risk-adjusted return. Expanding to more assets would very likely further smooth out the equity curve.

Conclusion

MACD provides a simple but effective trend-following tool for crypto trading. Its logic is easy to automate and performs well across different coins.

Track the 👉 live implementation to follow its performance and future evolution.