Short-Term RSI Reversal Pattern That Works (Backtest Results + Live Strategy)

This strategy is based on short-term mean reversion — buying when assets become oversold and exiting during recovery. While sometimes confused with scalping, this approach operates on a daily timeframe, making it more of a fast swing strategy than an intra-day one.

What is RSI?

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It oscillates between 0 and 100, with readings above 70 traditionally considered overbought and readings below 30 considered oversold. These thresholds can be adjusted depending on market conditions and the specific asset being traded.

Our RSI Strategy Rules

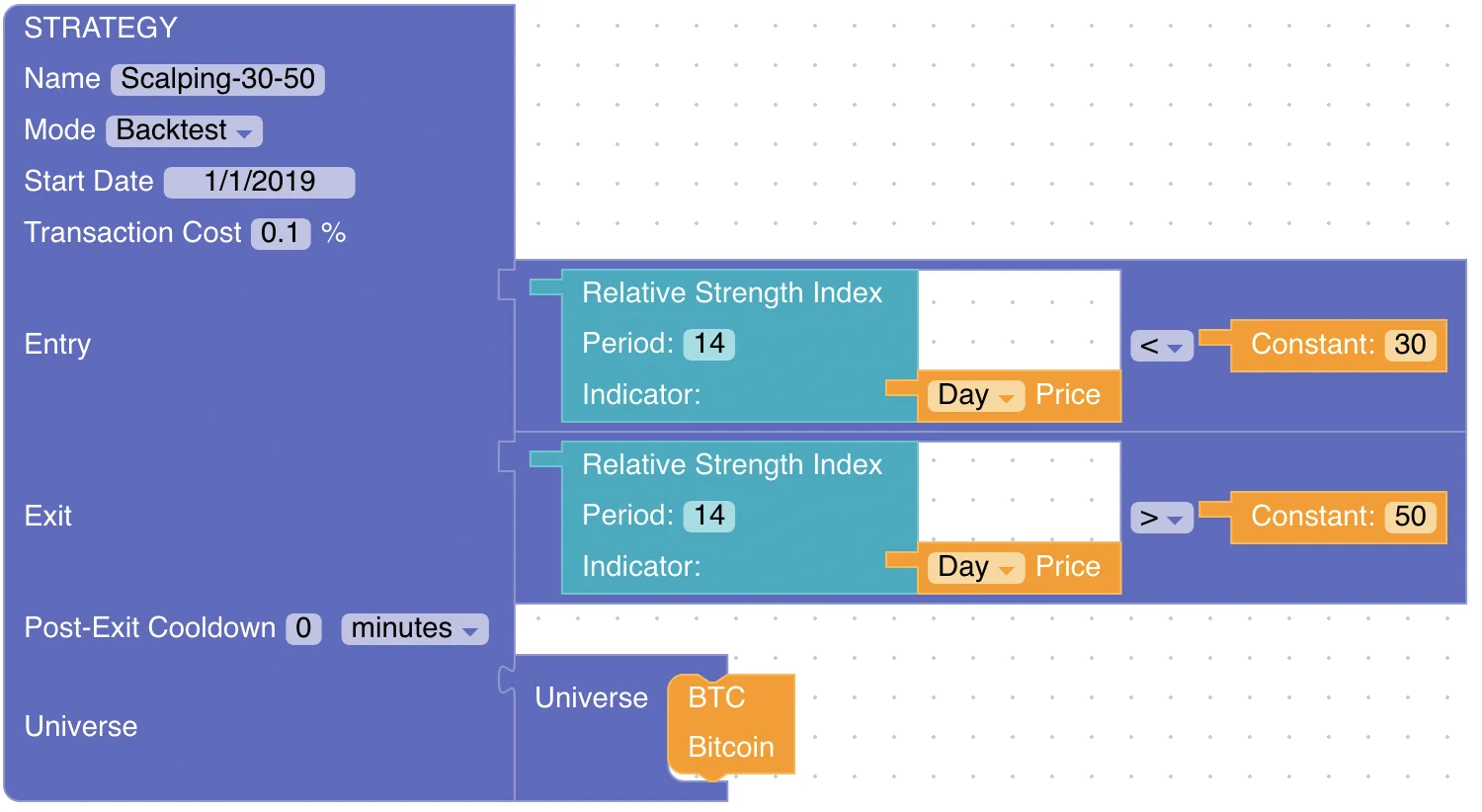

Let's define the strategy as follows:

This strategy uses RSI(14) with a slightly non-traditional approach:

- Entry: RSI drops below 30 (oversold territory)

- Exit: RSI rises above 50 (recovering strength)

- Timeframe: Daily candles on Bitcoin (BTC)

This method aims to catch short-term reversals by buying during oversold conditions and exiting once the asset begins recovering, without waiting for full overbought conditions.

Strategy Performance

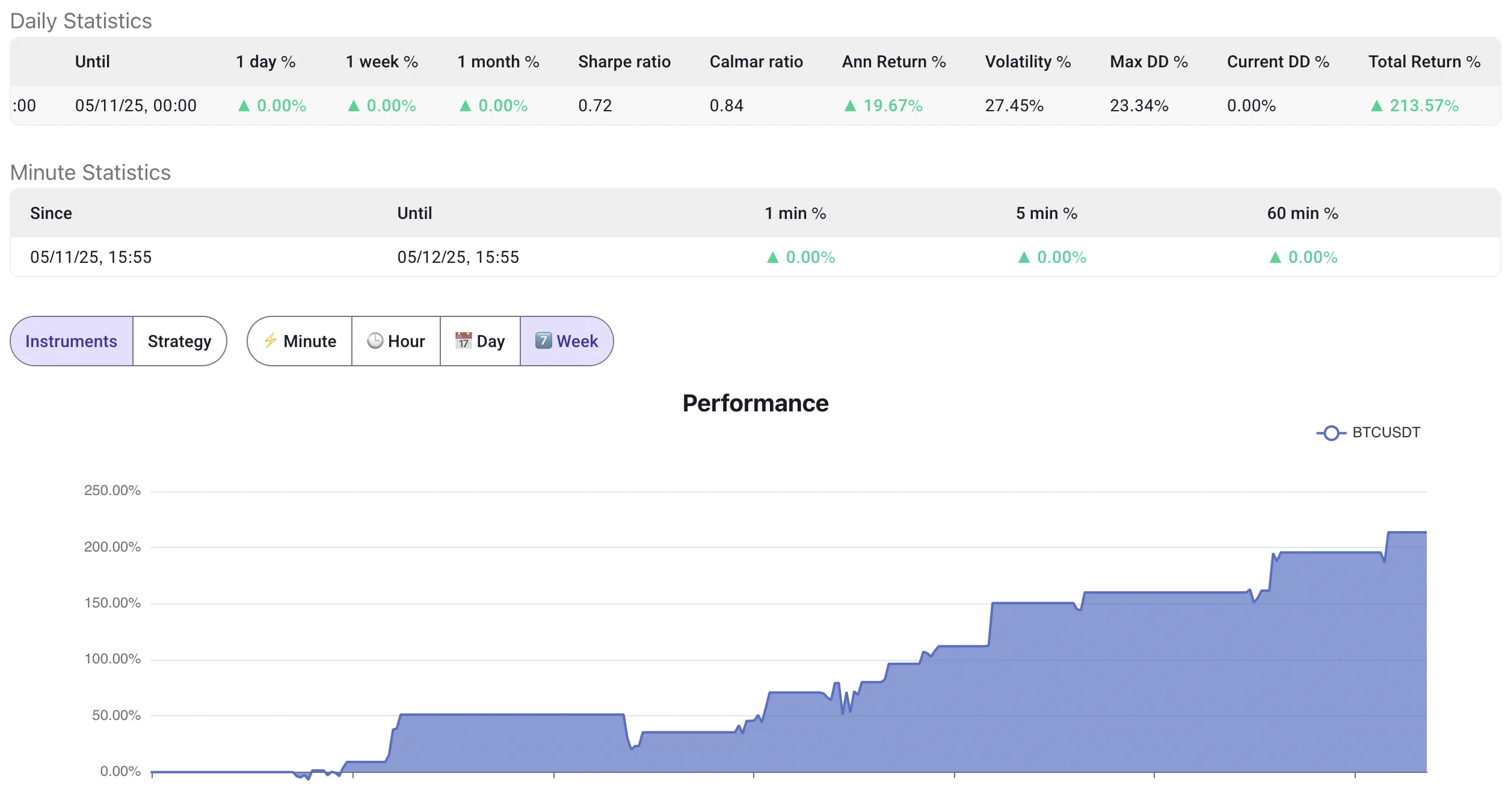

Here are the results of the strategy on BTC:

- Annualized Return:

19.67% - Maximum Drawdown:

23.34%

Strategy results can be inspected here.

These results are compelling given the relatively low market exposure. The strategy stays out of the market most of the time, reducing risk during unfavorable trends.

Diversification Improvement

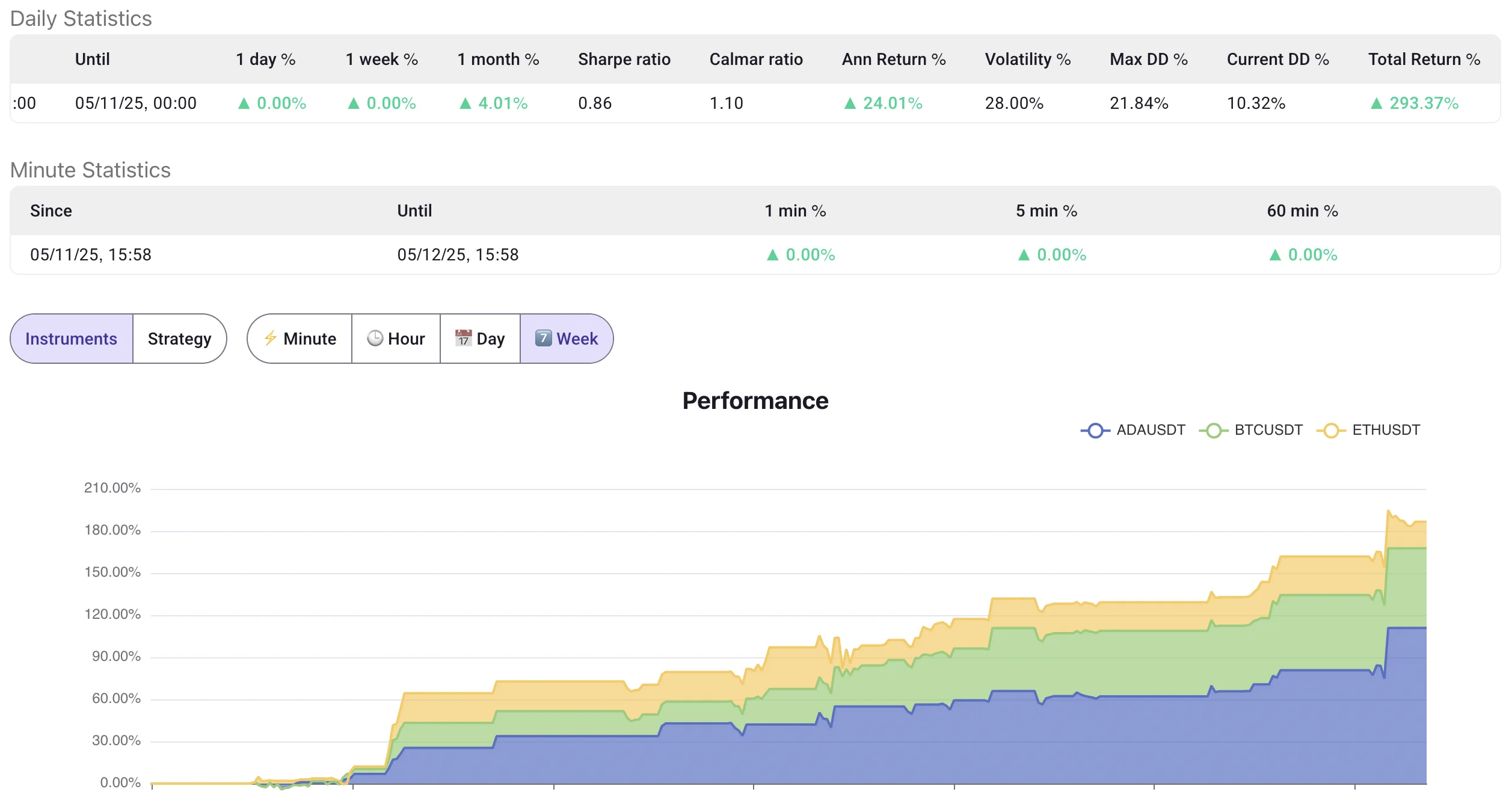

To enhance robustness, we expanded this approach to Ethereum (ETH) and Cardano (ADA), using the same RSI rules:

Key improvements:

- More consistent performance across market phases

- Lower volatility in returns

- More frequent trading signals

Backtest results are available here.

Live Implementation

A live clone of the diversified strategy is available here:

👉 RSI-30-50-btc-eth-ada

It runs in real time, tracking the strategy’s performance across three major cryptocurrencies.

Potential Strategy Improvements

-

Trend Filter: Use a 200-day moving average to only enter long when price is above the long-term trend. This can reduce drawdowns.

-

Timeframe Optimization: Test shorter or higher timeframes to adjust for different market cycles.

-

Asset Expansion: Apply the rules to more cryptocurrencies to further reduce risk and improve returns through diversification.

Conclusion

This RSI-based short-term reversal strategy offers a systematic way to capture recovery moves after sharp declines. By exiting early, it avoids holding through uncertain conditions and minimizes overexposure.

Its simplicity makes it a strong candidate for automation, and it performs even better when applied to a diversified crypto portfolio.

Follow the live 👉 live implementation and stay updated as the strategy adapts to real market conditions.